Hardware is hard

Hardware is hard. This old cliché is very well known in the startup community. Apart from the obvious truth that any startup project is a difficult task, I want to investigate some of hardware’s traditional challenges and some new challenges that have changed the hardware startup landscape in recent years.

Traditionally, hardware has been considered not for the faint-hearted because of the sheer difficulty of creating an innovative device into the physical world. With any development, you must go through the learning loop many times, and that process of Develop – Build – Test – Reflect takes longer and costs more when you are creating physical models and prototyping a physical device as opposed to writing code. The increased risk and expense for hardware development is still true even after the cost barrier dropped somewhat in recent years with the advent of CAD, 3D printing and rapid prototyping. In spite of the challenges of higher expense and length of time required to develop, there has always been plenty of innovators developing new products and plenty of keen investors looking to get in early and support that innovation. In the last two years, some new hurdles have been added for the hardware startup to deal with. These challenges are temporary although there is uncertainty around when they will ease. They are unprecedented and have increased the difficulty of hardware development considerably.

The COVID pandemic has created a greater demand for hardware devices as more of us now work and play from home. While this is a positive and seemingly ongoing trend for hardware, it has contributed to the worldwide supply chain crisis which affects the availability and cost of components negatively. This has since been followed by the semiconductor shortage, another blow to tech manufacturing. Add to this the lockdowns and travel restrictions which slow work in collaboration for the three hardware disciplines (hardware/firmware/prototyping). Unlike software developers, hardware, firmware and prototyping teams need to collaborate in person from time to time. If this is not possible, it slows development and pushes up costs.

Ideally, it goes something like this...a new product is conceptualised, drawn then discussed at length in order to nail down the UVP (Unique Value Proposition) and the disruption it creates within an existing market. If this new invention has merit, a start-up is formed, and this small team invest their own funds initially to create a mock-up or proof of concept. Further (friends and family) investment is often needed to complete all the tasks consisting of design, development and build along with the commencement of any intellectual property protection required. Usually, it takes a number of models and at least one prototype to achieve proof of concept. After this effort and expense and if the proof of concept actually works as figured then the team might connect with a larger entity for licensing or a partnership, or they might look to develop and manufacture themselves.

At this stage decisions are made on the path to market. The hardware startup path to market is high risk, high reward which involves the start-up seeking further investment to develop and commercialise in-house. Alternatively, at this stage they could choose to license or sell the product entirely to another established manufacturer who will take on the risk and cost to commercialise, this is the lower risk lower reward model. This decision is made based on factors such as the start-up team’s ability to execute, available funding and the attractiveness of any potential licensing opportunities. A committed and capable hardware startup should take the leap and develop in-house, this brings us to the final new challenge for hardware – investment.

Until the pandemic and supply chain issues came along there were plenty of early stage hardware investors, but that has changed from the top down. Venture Capitalists opted out first, which trickled down to Angel Investors. This lack of investment has in turn seriously affected the number of founders developing hardware (cue tumbleweeds).

Once proof of concept is achieved the hardware startup must first look to Angel investment. Angels have traditionally been happy to get in at the seed or even pre-seed stage and help the hardware team complete development and commercialise. Angel investors have seen the change of policy from the Venture Capitalists and have also deemed pre-commercial hardware borderline risky and many have “ran for the hills” when it comes to investing. When Angels do consider hardware, they now want greater percentages of the company for less money to compensate for the perceived extra risk. This creates a situation that is often not viable considering an Angel investment will be the first sophisticated investment the start-up has taken. This is a stage where the founders will look to give up 10- 20% of their company knowing there will be a need for much more follow on investment once they’re actually manufacturing the product. Unfortunately, there is no opportunity for investment from Venture Capitalists either, although once there were many hardware-centric VC’s that would happily support the right team and project from the pre-commercial stage especially if you had solid proof of concept, an industry alliance and IP protection such as a patent.

Now, if they do look at hardware they are looking for post-commercialisation only with a start mark of around $2 million in ARR (annual run rate), meaning if you have reached market and generated at least $166,666 in your first month’s sales, this extrapolates to $2 million annually. The problem is that it takes years and most often greater than $1 million dollars to develop and commercialise a product. So, Venture Capitalists are no longer a viable funding option at the hardware seed stage. This leaves the final group of investors - High Net Worth Individuals (HNWI). These wealthy individuals are the last bastion of investors that accept pre-commercial risk for the right potential ROI (return on investment) or for the love of a project. The problem is these individuals are not easy to find and a start-up can easily run out of money chasing their own tails looking for a wealthy investor.

It certainly seems it is far harder now than before to commercialise hardware. There are many more hurdles in development, and there are fewer investors and inevitably there will be fewer government grants for hardware. It is important to acknowledge that this extra difficulty caused by the current constraints is temporary. It adds difficulty, but it will not last. It seems akin to a dry growing season.

Grapes are better in dry seasons

Grapes grown in the harsher difficult conditions of a dry season are known to be richer with nutrients and sweeter, resulting in a higher quality wine. Why are grapes better in dry seasons? The short answer is due to less water, and warmer temperatures there are smaller yields and the Grapes that do make it are denser and richer with nutrients and ultimately far more delicious than a regular grape. This may also be true of a start-up in challenging times. Difficulty in any particular sector for a period ensures fewer participants, but maybe it also ensures those teams that do persist and find a way to develop and grow in spite of the challenges are higher quality overall with greater belief, skills and perseverance. Start-up founders live for the journey, through the good and bad they must maintain the ultimate belief in their vision.

After all, a disruptive innovation is no less of a disruption just because the business conditions happen to be difficult at the time of development. Every start-up requires belief, and an absolute dedication to the cause without waiver. Good investors can spot this, they understand the effort that has gone in, the challenges that have been overcome. They know evidence of overcoming adversity and struggle trumps ease of development, an abundance of materials and a trending technology every day.

Hardware development does have some challenges right now, but they won’t last, just like a warm dry growing season doesn’t last.

Join the VIP Waitlist

Be informed of all the latest updates as they are released and be one of the first to know when the ProSteer is available. You'll also get VIP pricing when we launch!

Sign Up - Footer

We will get back to you as soon as possible.

Please try again later.

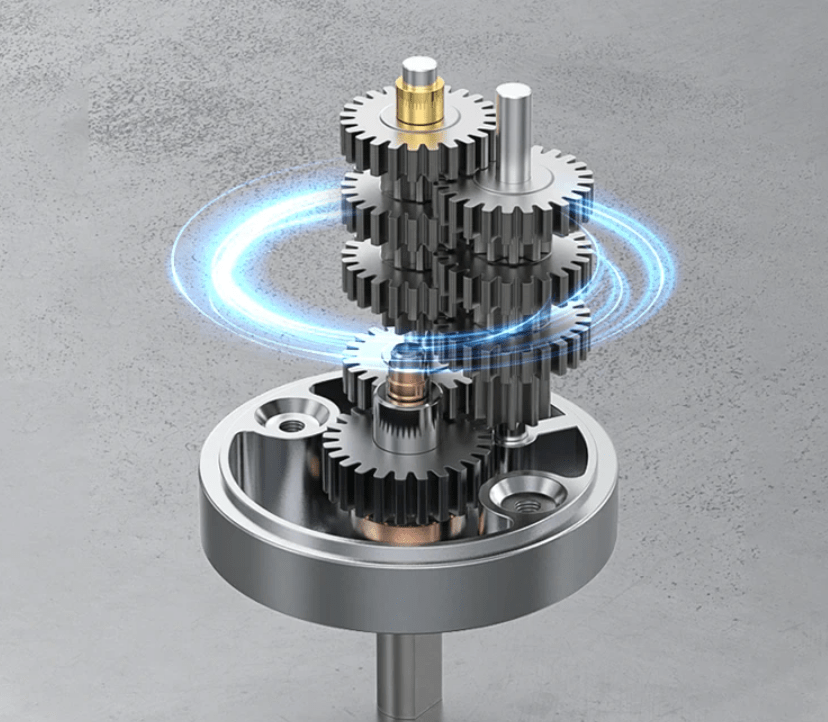

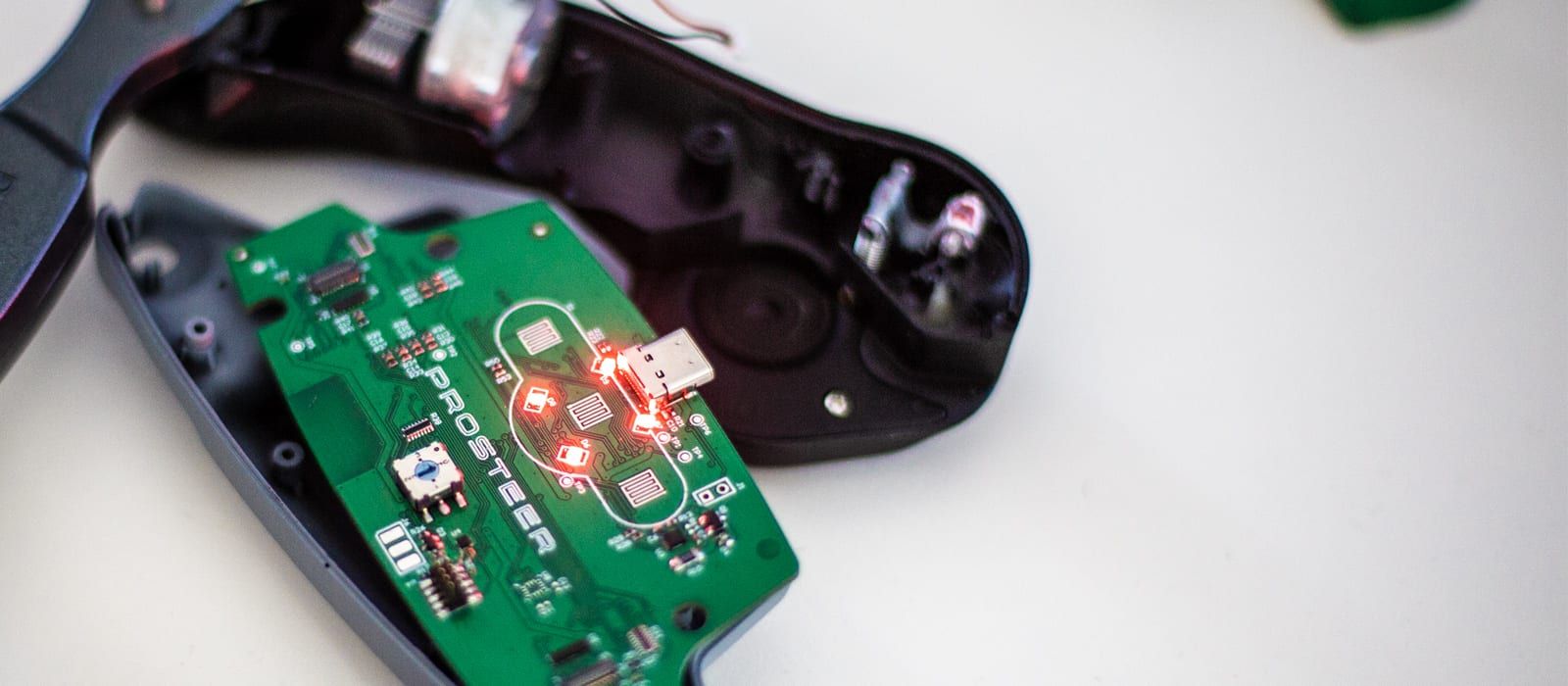

We have created a whole new species of game controllers. Our R&D spans three continents and over 5 years. BoxDark is focussed on fine tuning our technologies to harness their many control advantages.

Quick Links

Looking to Invest?

ProSteer is in the final development phase before launch, our “Boxed Arc” handheld steering technology provides gamers with a Unique Value Proposition and is US and Australian patented

All Rights Reserved | ProSteer | Privacy Policy

Carefully Designed by PupDigital